Answer:

Market price today $955.1347

Step-by-step explanation:

To know the current market price we will calculate the present value ofthe cuopon payment and the maturity at the yield to maturity rate of 8.73%

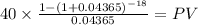

Present value of the annuity

Cupon Payment: 1,000 face value x 8% / 2 payment per year = 40

time = 9 years x 2 payment per year = 18

rate = 8.73% = 0.0873 = 0.0873/2 = 0.04365

PV $491.6747

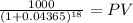

Present value of the maturity

Maturity = face value = 1,000.00

time 18.00

rate 0.04365

PV 463.46

Now we add both together to get the present value of the bond

PV c $491.6747

PV m $463.4599

Total $955.1347