Answer: Option (c) is correct.

Step-by-step explanation:

Given that,

EPS = $3.50

Book value per share = $22.75

Shares outstanding = 220,000

Debt-to-assets ratio = 46%

Total Equity (Book Value) = Book value per share × Shares outstanding

= $22.75 × 220,000

= $5,005,000

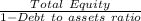

Total Assets =

=

= $9,268,518.52

Debt outstanding = Total Assets - Total Equity

= $9,268,518.52 - $5,005,000

= $4,263,518.52

= $4,263,519 (approx)