Answer:

$6,217

Step-by-step explanation:

Total expenditure incurred = $7,000 + $14,500 + $11,000 + $8,000 + $1,000

= $41,500

If Egret Selects to make, sec 195 election, then he can deduct $5,000 initially and the remaining in equal 180 installments.

her, in the given instance total months in current year = 1 July to 31 December = 6 months.

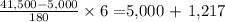

Therefore, deduction shall be

$5,000 +

= 6,217

= 6,217