Answer:

before disrtibution of dividends: 34,125,000

after distribution: 33,475,000

Step-by-step explanation:

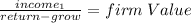

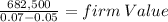

we will calculate this using the gordon model for dividen grow but using the firm income asdividends instead:

income zero: 650,00

income next year: 650,000 x 1.05 = 682,500

return 7%

grow 5%

firm value: 34.125.000

once it distribute dividends, the equity will decrease by that ammount:

34,125,000 - 650,000 = 33,475,000