Answer:

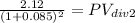

Current Market value of the stock at 8.5% return: 105.88

Step-by-step explanation:

We will calculate the present value of the dividends:

![\left[\begin{array}{ccc}Year&Cash \: Flow&PV\\</p><p>1&1.722&1.59\\</p><p>2&2.12&1.8\\</p><p>3&2.61&2.04\\</p><p>4&3.21&2.32\\</p><p>5&3.40&98.13\\</p><p>&&105.88\\</p><p>\\\end{array}\right]](https://img.qammunity.org/2020/formulas/business/college/9d8qpogmhqh8b2jkkpzkbesh4y41q0m2dj.png)

We will do the following:

each dividends we multiply by the previous, by the grow rate of 23%

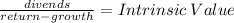

D1 1.40 x ( 1 + 23%) = D2 = 1.722

D2 1.722 x ( 1 + 23%) = D3 = 2.12

...

Then after the four years we calculate the gordon model for the infinite series of dividends

3.95/(0.085-0.06) = 158

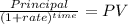

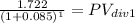

Then calculate the present of each dividends applying the present value of a lump sum

PV div1 = 1.59

PV div2 = 1.8

PV div3 = 2.04

...

Then we add them and get the present value of the stock