Answer:

a. Contribution from Berry = $6,000

b-1. Contribution from Hammond = $22,556

b-2. Disbursement shall be:

Anderson = $8,889

Berry = $3,667

c. Amount to be received by Anderson on Liquidation = $11,500

Step-by-step explanation:

As for the provided information we have,

Capital balances

Anderson 40% $20,000

Berry 30% $12,000

Hammond 20% $17,000 (Deficit)

Winwood 10% $25,000 (Deficit)

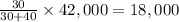

a. Total deficit in this case will be = Share of Hammond + Winwood = $17,000 + $25,000 = $42,000

Berry's share =

Since Berry's current balance = $12,000

Contribution required = $18,000 - $12,000 = $6,000

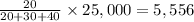

b-1. Total deficit of Winwood = $25,000

Hammond share =

Hammond's current balance = - $17,000

Thus, contribution from Hammond = $5,556 + $17,000 = $22,556

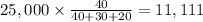

b-2. Total deficit balance = $17,000 + $25,000 = $42,000

Total sufficient balance = $20,000 + $12,000 = $32,000

Net deficit balance = $42,000 - $32,000 = $10,000

Anderson share in Deficit of Winwood =

Thus, net capital of Anderson = $20,000 - $11,111 = $8,889

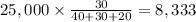

Berry's share in deficit of Winwood =

Thus, net capital from Berry = $12,000 - $8,333 = $3,667

c. Total deficit from Hammond = $17,000

Anderson share =

Anderson's current balance = $20,000

Amount extra contributed by Anderson = $20,000 - $8,500 = $11,500

Thus, Anderson will receive $11,500 on liquidation.

Final Answer

a. Contribution from Berry = $6,000

b-1. Contribution from Hammond = $22,556

b-2. Disbursement shall be:

Anderson = $8,889

Berry = $3,667

c. Amount to be received by Anderson on Liquidation = $11,500