Answer:

4000 shares

Step-by-step explanation:

Given:

Exercisable price per share = $50

Number of shares of common stocks to be obtained = 24,000

Average market price of the common share = $60

Ending market price per share = $60

Total Amount for the shares = Number of shares × Price per share

or

Total Amount for the shares = 24,000 × $50 = $1,200,000

Thus,

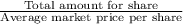

number of shares purchased =

or

number of shares purchased =

or

The number of shares purchased = 20000

Hence,

Increased weighted-average number of shares

= Shares to be obtained - Actual number of shares purchased

or

= 24000 - 20000 = 4000 shares