Answer:

Monthly Payment $ 515.92

Explanation:

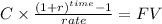

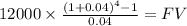

First we calculate the value of the loan after the four years:

We will calcualte that using the future value of an annuity of $12,000 for 4 years at 4%

C 12000

time 4

rate 0.04

FV $50,957.57

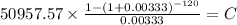

Now we have to calculate the cuota of a 10 years loan with this value as the principal.

PV $50,957.57

time 10 years x 12 months per year = 120

rate4% per year / 12 months = monthly rate = 0.00333

C $ 515.92