Answer:

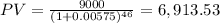

Answer d) $6,913.53

Explanation:

Hi, we have to bring the maturity value to present value, that is 3 years and 10 months before its due date (46 months, since 3 years +10 months is 46 months).

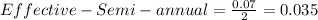

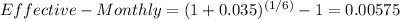

ok, in order to come up with the simplest solution to this problem, we have to turn this interest rate (7% compounded semi-annually) into an effective monthly rate. That is as follows.

In other words, our discount rate is 0.575%

Now, we take it to present value using the following formula.

Best of luck.