Answer:

The value of its operations is 2,120,000.

Step-by-step explanation:

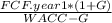

The value of the company is equal to the present value of the future cash flows. It could be calculated in many ways, but one of the simplest is

Where G is the expected grow rate, and WACC is the cost of capital.

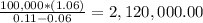

In this case, the value will be equal to