Answer:

an operating profit

Step-by-step explanation:

Where:

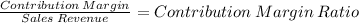

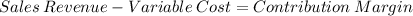

The sales, after variable cost, generate a contribution, this contribution in relationship with sales can be measure as a ratio.

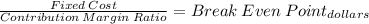

And this ratio applied to fixed cost get us the sales level at which the company can aford both, their fixed cost and variable cost.

Resuming:

The break even is the sales level which generate enough contribution to pay up the fixed cost and the variable cost generated for the sales.

If sales are higher than BEP then it will pay their variable and fixed cost and also make a profit.