Answer:

WACC 10.01825%

Step-by-step explanation:

before calculate WACC we need to calculate the equity and debt weights

Debt 262,000

Value 548,000

Equity 548,000 - 262,000 = 286,000

Weight of Debt 262,000/548,000 = 0.52189781

Weight of Equity 286,000/548,000 = 0.47810219

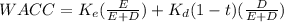

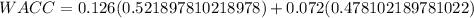

Now we can solve the WACC

Ke = cost of equity = 0.126

Equity weight 0.52189781

Kd(1-t) = after-tax cost of debt = 0.072

Debt Weight 0.47810219

WACC 10.01825%