Answer:

12.46%

Step-by-step explanation:

Data provided:

Amount invested in Stock A = $1,750

Amount invested in stock B = $3,950

Expected rate of return on stock A = 9%

Expected rate of return on stock B = 14%

Thus,

Expected amount of return on stock A

= Amount invested in Stock A × Expected rate of return on stock A

on substituting the respective values, we have

= $1,750 × 0.09 = $157.5

and,

Expected amount of return on stock B

= Amount invested in Stock B × Expected rate of return on stock B

on substituting the respective values, we have

= $3,950 × 0.14 = $553

Therefore, the total expected return from both the stocks = $157.5 + $553

= $710.5

Now,

the total amount invested = $1,750 + $3,950 = $5700

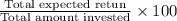

Hence, the expected rate of return on the portfolio

=

on substituting the values, we get

=

the expected rate of return on the portfolio = 12.46%