Answer:

The risk free rate is 1.5632%

Step-by-step explanation:

The expected return of stock is calculated with the formula

So, for A and B, the calculation is

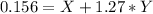

- A -->

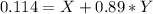

- B -->

If we clear X in the first equation and we replace that in the second, we get: