Answer:

A.- we need to fund 1,000,000 to achieve a 50,000 dollar perpetuity.

B.- There will be 1,105 dolalrs after 10 years.

Step-by-step explanation:

Formula for perpetuity:

annuity/rate = principal

50,000/0.05 = 1,000,000

we need to fund 1,000,000 to achieve a 50,000 dollar perpetuity.

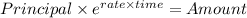

B.- continuous interest formula:

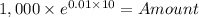

we plug our values:

we deposit 1,000 dollar for 10 years at 1% rate

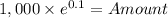

And now we solve:

Amount = 1,105.170918 = 1,105