Answer:

Return on Equity = 13.17%

Step-by-step explanation:

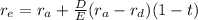

We solve for cost of equity using the MM model with taxes.

r_a = retrun on asset or unlevered return =0.12

D/E = 0.60

r_d = cost of debt = 0.09

taxes = 35% = 0.35

re = return on equity = 0.1317 = 13.17%