Answer:

The correct answer is 7.27%.

Step-by-step explanation:

The price of the bond is $1,100.

The face value is $1,000.

The coupon rate is given as 8%.

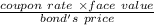

The current yield of the bond will be

=

=

=

= 0.0727

This means that the current yield on the bond is 7.27%.