Answer: The market price per bond is $930,28.

Explanation: First we must calculate the amount of each coupon.

1000 x 7% = 1000 x 0.07 = $ 70 each coupon.

The payments are semiannual and the bond expires in 9 years therefore we have a n = 9 x 2 = 18.

The yield to maturity is 7.73%

And the face value is 1000 $

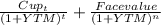

P0 = ∑

Where t is equal to each of the periods of time.

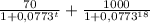

So:

∑

= 930,28

= 930,28