Answer:

Value of firm today = $2,000,000

Step-by-step explanation:

Provided details are,

Future Cash Flow = $100,000

Expected growth rate = 6.5%

Weighted average cost of capital = 11.5%

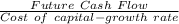

Firm's total corporate value =

=

=

= $2,000,000

Thus, value of firm today with the details provided = $2,000,000