Answer:

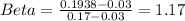

Beta of the stock is 1.17.

Step-by-step explanation:

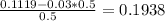

The return of this portfolio is Stock Return * 0.5 plus Risk free return * 0.5. So, the return of the stock is

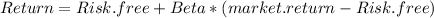

The expected return of a stock is determined:

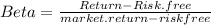

So, if we clear Beta from that equation

Replacing with numbers