Answer:

4.40

Step-by-step explanation:

For the nature of the Yield to Call and Yield to maturity

You can eiher solve with excel, a financial calculation or with approximation method

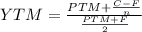

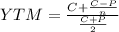

This will be the formula for approximation method

PTM= 41.25 (1,000 x 8.25 = 82.5 annual interest divide by 2 as there are semiannual payment)

C= 1045 This is the value of the called bond

F= 1000 The face value of the bond

n= 12 (6 years 2 payment per year)

We plug this into the formula and solve

partiel result of the upper part: 45

partial result, divisor: 1022.5

quotient 4.4009780%