Answer:

NPV 3.461,36 at 11% discount rate, it should be accepted

NPV -2,882.4 at 25% discount rate, it should be rejected.

Step-by-step explanation:

We will calculate the present value of the cash flow at each discount rate.

First we will do 11% and then 25% discount

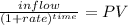

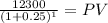

Year 1 cash inflow: 12,300.00

time 1

rate 0.11

PV 11,081.08

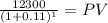

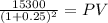

Year 1 cash inflow: 15,300.00

time 2

rate 0.11

PV 12,417.82

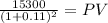

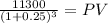

Year 3 cash inflow: 11,300.00

time 3.00

rate 0.11

PV 8,262.46

Next, we add the project three years to get the total inflow.

Total value of the cash inflow:

11,081.08 + 12,417.82 + 8,262.46 = 31,761.36

Last, the net present value

present value of the cash inflow - investment

31,761.36 - 28,300 = 3,461.36

It is postive, this means the project yields at a better rate than 11%. The project should be accepted.

Now, we repeat for the second discount rate of 25%

Year 1 cash inflow: 12,300.00

time 1

rate 0.25

PV 9,840.00

Year 2 cash inflow: 15,300.00

time 2

rate 0.25

PV 9,792.00

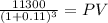

Year 3 cash inflow: 11,300.00

time 3

rate 0.25

PV 5,785.60

Using a 25% discount rate, the present value of the cash inflow:

9,840.00 + 9,792.00 + 5,785.60 = 25,417.6

NPV: 25,417.6 - 28,300 = -2,882.4