Answer:

Stock A is the best option.

Step-by-step explanation:

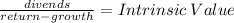

We use gordon dividend model

return for all stock = 10%

Stock A

dividend 10

grow = 0

10/.1 = 100

Stock B

dividend 5

grow 0.04

5/(0.10-0.04) = 83.33

Stock C

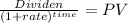

For this case, we will calculate the present value of the dividends, as there is a finite number

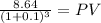

We get each dividen by multiply the previous one by the grow rate

Year 1: 5dividends x (1 + 20% grow)= 5 x 1.2 = 6

Year 2: 6 dividends x 1.2 = 8.64

And so on.

Then we calcualte the present value for each dividend:

Then we add them together and get the value of stock C

![\left[\begin{array}{ccc}Year&Dividend&Present Value\\1&6&5.4545\\2&7.2&5.9504\\3&8.64&6.4914\\4&10.368&7.0815\\5&12.4416&7.7253\\Net&Value&32.7031\\\end{array}\right]](https://img.qammunity.org/2020/formulas/business/college/6uuhi84zu32ih43qaycitlavj1s4a604eu.png)

stock C 32.7031

From the comparrison, Stock A is the best option.