Answer:

Amount for each stock to be paid at maximum = $54

Step-by-step explanation:

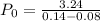

Using Dividend growth model, we have,

Where

= Expected price of share today

= Expected price of share today

= Dividend to be paid at this year end

= Dividend to be paid at this year end

=

= Required return on investment

= Required return on investment

g = Growth rate

Therefore,

= = $3 + 8% = $3.24

= = $3 + 8% = $3.24

= $54

= $54

Therefore, current price for this share or sock to be paid = $54 per share.