Answer:

WACC = 0.079 and firm value = 12,658.23.

Step-by-step explanation:

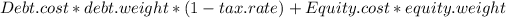

WACC is equal to

Where debt cost is 0.05, debt weight is 0.3, tax rate is 0.4, equity cost is 0.1 and equity weight is 1-0.3 = 0.7

So, WACC = 0.05*0.3*0.6 + 0.1*0.7 = 0.079 or 7.9%.

The value of the fir is calculated FCF/WACC, in this case 1,000/0.079 = 12,658.23.