Answer:

NPV of the project 497,000

Step-by-step explanation:

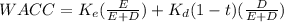

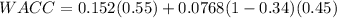

First, we calcualte the WACC for the firm

Ke= cost of capital= 0.152

Equity weight 0.55

Kd= cost of debt= 0.0768

Debt Weight 0.45

tax rate= 0.34

WACC 10.64096%

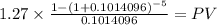

Then, we adjust for the proposed factor: (-0.5 percent)

10.64096% - 0.5% = 10.14096% This will be the project rate.

Now, we calcualte the NPV

The present value of the cash inflows:

C 1.27

time 5

rate 0.1014096

PV $4.7970

NPV = 4.797 millions - 4.3 millions = 0.497 millions = $497,000