Answer: Yield to maturity = 2 × 3.037 = 6.07%

Given:

Face Value = $1000

Bond Price = $1115

Semi annual coupon interest = 1000 ×

% = $ 35

% = $ 35

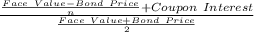

We'll equate the semi yield to maturity, using the following formula:

Semi yield to maturity =

where;

n = no. of semi annual period = 40

Using the value in above equation, we get

Semi yield to maturity =

Semi yield to maturity = 3.037%

Therefore , yield to maturity = 2 × 3.037 = 6.07%