Answer:

The stock price 5 years from now will be 44.46

Step-by-step explanation:

The stock price will increase like compound interest at the same rate as the dividends.

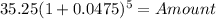

Stock 35.25

time 5

dividend grow rate 0.0475

Amount 44.45588696

The stock price 5 years from now will be 44.46

Reasoning:

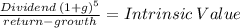

In five years, if we calcualte the gordon dividend growth model:

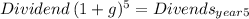

and year 5 dividends would be:

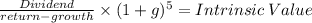

we can arrange the formula like this:

The first part is the current stock price so our formula is confirmed.