Answer: Net present value = $446,556

Step-by-step explanation:

First we'll compute the Weighted Average Cost of Capital :

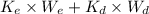

Weighted Average Cost of Capital =

= 0.163×

+ 0.0729× (1 - 0.35 )×

+ 0.0729× (1 - 0.35 )×

= 0.1255

where;

= Cost of equity

= Cost of equity

= Proportion of equity

= Proportion of equity

= Cost of debt

= Cost of debt

= Proportion of debt

= Proportion of debt

Now, we'll compute the cost of capital using the following formula:

Cost of capital = Weighted Average Cost of Capital + adjustment factor

= 0.1255 + 0.0125

= 0.138 or 13.8%

∴ Net present value = Cash outflows - Total PV of cash flows

= $3,900,000 - $1,260,000 (Annuity value of 13.8% for 5 years)

![= 3,900,000 - 1260000 * ([1-(1+13.8)^(-5)])/(13.8)](https://img.qammunity.org/2020/formulas/business/high-school/lp929qhm76u85mbgvenry1kzwac1hqnvjo.png)

= $3,900,000 - $3,453,444

= $446,556

Therefore, the correct answer is option(b).