Answer: EV/EBITDA = 4.69

Step-by-step explanation:

Given that,

Annual revenue = $387,000

Costs = $216,400

Depreciation = $48,900

Tax rate = 30 percent

Debt outstanding with a market value = $182,000

9,500 shares of stock that is selling at $67 a share

Cash = $48,000

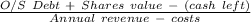

EV/EBITDA =

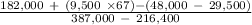

EV/EBITDA =

EV/EBITDA =

EV/EBITDA = 4.69