Answer:

maximum amount = 7,170.28

Step-by-step explanation:

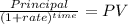

We will calculate using the present value of a lump sum

For year 1

Principal 3,000.00

time 1.00

rate 0.11

PV 2,702.70

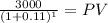

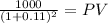

For year 2

Maturity 1,000.00

time 2.00

rate 0.11

PV 811.62

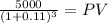

For year 3

Maturity 5,000.00

time 3.00

rate 0.11

PV 3,655.96

We add them to get the present value ofthe cash flow

3,655.96 + 811.62 + 2,702.70 = 7,170.28

This will be the maximun amount we can pay for the investment at our current rate. more than this sum will generate a negative net present value