Answer:

The risk free will be 3.82%

Step-by-step explanation:

We post the CAPM formula and how given data

risk free ?

market rate 0.12

premium market market rate - risk free ?

beta(non diversifiable risk) 3.2

Ke = 0.3

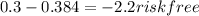

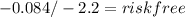

Now we post the know values and solve for risk free

risk free = 0.0381818181818182 = 3.82%