Answer: $46,380

Step-by-step explanation:

Given that,

Item X was appraised = $38,000

Item Y was appraised = $60,000

Item Z was appraised = $65,000

Purchase price = $126,000

Sum of the value of items appraised = $38,000 + $60,000 + $65,000

= $163,000

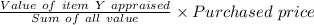

The amount at which item Y should be recorded:

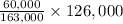

=

=

= $46,380