Answer: Depreciation for the first year = 17825

Step-by-step explanation:

Given:

Machine purchased for $125,000

Salvage value of $10,000

Output = 100,000

First year of operation, Output = 15500

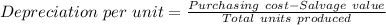

First, we'll evaluate depreciation per unit over the entire life of the machine:

i.e.

Depreciation per unit =

Depreciation per unit = 1.15

Now, we'll compute the depreciation for the first year:

Depreciation for the first year = Depreciation per unit × Output (first year)

Depreciation for the first year = 1.15 × 15500

Depreciation for the first year = 17825