Answer:

It will be willing to pay up to $297,853.46

Step-by-step explanation:

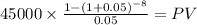

First, we calculate present value of the cash saving

C 45000

time 8

rate 0.05

PV $290,844.57

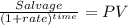

Then, the present Value of the salvage value

Maturity 7.50 %

time 8.00

rate 0.05

PV 5.08 %

This is calculate as a percent, because we are not given with a cash value.

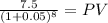

Last, the 12,000 major overhaul

Maturity -12,000.00

time 8.00

rate 0.05

PV -8,122.07

This PV is negative as it is a cash out-flow

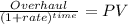

Lastly, we add them all:

290,844.57 + 0.0508PV - 8,122.07 = PV

And solve for PV

290,844.57 - 8,122.07 = PV - 0.0508PV

282,722.5 = 0.9492PV

282,722.5/0.9492 = PV

PV = 297,853.455541 = 297,853.46