Answer:

Sell the future and buy the british pound.

Step-by-step explanation:

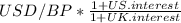

The non arbitrage parity explains that the future exchange rate is the cost of carrying the underlying asset. In the case of currencies is

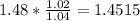

If we replace with numbers:

That means the future exchange rate is actually cheaper than the value of the forward. So, in order to make profits, you have to sell the future and buy the british pound. In one year, you will win 1.47 - 1.4515 = 0.0185.