Answer:

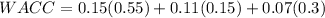

B) WACC 12.00000%

Step-by-step explanation:

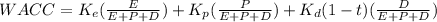

Ke 0.15 (we are asked for the WACC if retained earnings are used, so we ould assing RE rate

Equity weight 0.55

Kp 0.11

Preferred Weight 0.2

Kd(1-t) (after-tax debt) 0.07

Debt Weight 0.3

WACC 12.00000%