Answer:

D) Ke = 11.79%

Step-by-step explanation:

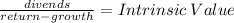

We will use the gordon dividen grow model to sovle for the cost of new equity

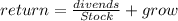

we clear for return

in this case we call the retun cost of equity

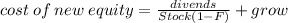

and we consider the impact of flotation ost, because this is new equity, which reduce the proceeds from the stock

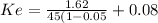

next year dividend 1.50 x 1.08 = 1.62

flotation cost 5% = 0.05

Stock 45

grow 0.08

Ke = 0.117894737 = 11.79%