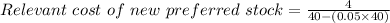

Answer: Relevant cost of new preferred stock = 10.53%

Step-by-step explanation:

Given:

Dividend = $4.00 per share

Selling for = $40 per share.

Flotation costs = 5% of the selling price.

Marginal tax rate is 30%.

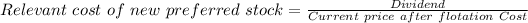

We can compute the cost of new preferred stocks using the following formula:

∴ Relevant cost of new preferred stock = 10.53%

Therefore, the correct option is (d)