Answer:

Cost of internal equity =21%

Cost of external Equity =23.29%

Step-by-step explanation:

Using the constant growth model:

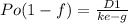

if ke is made subject of formula then the cost of internal equity ke is calculated as follows:

=

=

= 21%

= 21%

If external equity is to be used, that means that the company will have to issue share to get a fresh infection of capital into the company, and is thus likely to face flotation costs. the company will receive a net of $20 minus flotation costs for every share sold.

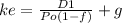

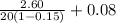

If ke is made subject of formula then the cost of external equity ke is calculated as follows:

=

=

= 23.29%

= 23.29%