Answer:

Price of the bond = $870.74

Step-by-step explanation:

The price of a bond is equivalent to the present value of all the cash flows that are likely to accrue to an investor once the bond is bought. These cash-flows are the periodic coupon payments that are to be paid semi-annually and the par value of the bond that will be paid at the end of the 4 years.

During the 4 years, there are 8 equal periodic coupon payments that will be made. In each year, the total coupon paid will be

and this payment will be split into two equal payments equal to

. This stream of cash-flows is an ordinary annuity.

. This stream of cash-flows is an ordinary annuity.

The yield to maturity is equal to 10% per annum and this equates to 5% per semi annual period.

The PV of the cashflows = PV of the coupon payments + PV of the par value of the bond

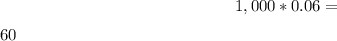

=30*PV Annuity Factor for 8 periods at 5%+ $1,000* PV Interest factor with i=5% and n =8

![=30*([1-(1+0.05)^-^8])/(0.05)+ (1,000)/((1+0.05)^8) =$870.74357](https://img.qammunity.org/2020/formulas/business/college/g19hyt6qw24dee02igrek2h3vsbx2xwkhn.png)