Answer:

Price of the stock at the end of three years =$34,27

Step-by-step explanation:

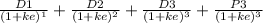

Price of the stock today =

.

.

Where D1 is the total dividend earned in year 1 =$0.2*4=$0.8

D1=D2=D3=$0.8

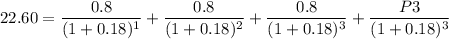

therefore, from the given information

.

.

Solve for P3, which is the price of the stock at the end of three years =$34,27.