Answer:

Forever Yours have to sell 3,642 bonds to raise $32million.

Step-by-step explanation:

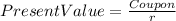

A consol is a bond with no maturity date. The coupon payments thus represent a perpetual income stream. The present value of a perpetuity is calculated as follows:

where r =yield to maturity

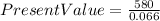

Therefore

= $8,787.88

= $8,787.88

Each console bond is currently selling at $8,787.88 and to raise $32 million , Forever yours will have to sell

bonds.

bonds.

This translates to 3,641.38 bonds. To raise enough money they will thus have to sell 3,642 bonds.