Answer:

Yield to maturity 7. 26 percentage

Step-by-step explanation:

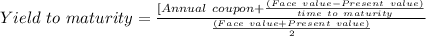

Yield to maturity is given as

annual coupon = $85

face value = $1000

present value = $1120

maturity period =15 year

putting all value to get yield to maturity value

=[85+(1000-1120)/15]/[(1000+1120)/2]

=7. 26%.