Answer:

The correct answer is A) $2.800

Step-by-step explanation:

Using the straight-line method to depreciate, the calculation to find the depreciation tax shield is the following:

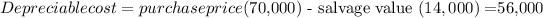

- Finding the depreciable cost:

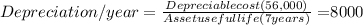

- Finding the depreciation per year:

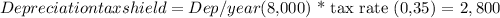

- Finally, the depreciation tax shield for 2018: