Answer:

bond market value $660

Step-by-step explanation:

We need to calculate the present value of the maturity and the cuopon payment using the effective rate of 9.7%

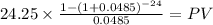

First we do the annuity:

C 24.25 (1,000 face value x 4.85 bond rate / 2 )

time 24.00 (12 year 2 payment a year)

rate 0.04850 (current rate divide by 2 to get it annually)

PV $339.55

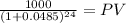

Then present value of the maturity

Maturity 1,000.00 the face value of the bond

time 24.00

rate 0.04850

PV 320.89

Finally we add them together:

PV coupon payment $339.5545

PV maturity $320.8910

Total $660.4455

rounding to nearest dollar

bond market value $660