Answer:

The correct answer is option B.

Step-by-step explanation:

The Fed lends $1 to the First National Bank.

The required reserve ratio is 10%.

There are no excess reserves with the bank.

This additional amount will cause an increase in the check-able deposits.

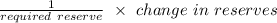

Change in check-able deposits

=

=

= $10 million