Answer:

the present value of the stock is 26.57

This will be the amount willing to pay per share today.

Step-by-step explanation:

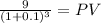

We have to calculate the present value of the future dividend

![\left[\begin{array}{ccc}Year&Cashflow&Present \: Value\\0&6&\\1&7&6.3636\\2&8&6.6116\\3&9&6.7618\\4&10&6.8301\\total&9.7&26.5671\\\end{array}\right]](https://img.qammunity.org/2020/formulas/business/college/4udg829ju71kriw7htaosue0qdvw24u0x6.png)

We will put each dividend and their year into the formula and solve for PV

First Year

Second Year

Third Year

Fourth Year

The value of the stock is the sum of the present value of their dividend

The sum for this firm is 26.5671 = 26.57