Answer:

Required return =10.1%

Step-by-step explanation:

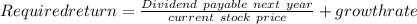

required return price is given by following relation

from the above information

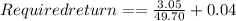

dividend payable next year is = $3.05

current stock price = $$49.70

growth rate = 4.00%

putting all value to get required return

Required return = 0.101

Required return =10.1%