Answer:

They should manufacture

It has a differential cost of 1,180,000 in the course of ten year of useful life for the machine.

Also the payback period of the investment is 2 years and the project life is 10 years. Which also is a good point in favor of manufacture the product

Return on Investment 393%

CAGR 14.68%

Step-by-step explanation:

300,000 x ($2 - $1.50) = 150,000 save per year

Buy Make Difference

Machine 250,000 -250,000

Working Capital 50,000 -50,000

Total Investment 300,000 -300,000

Cost 600,000 450,000

In ten Years 6,000,000 4,500,000 1,500,000

Salvage value 20,000 20,000

Total 6,000,000 4,820,000 1,180,000

Other method:

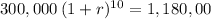

investment of 300,000

cost saving per year 150,000

payback: 300,000/150,000 = 2 years

Return on Investment:

1,180,000/300,000 = (3 + 14/15) = 3.9333333= 393%

CAGR

compound annual growth rate:

r = .1468 = 14.68%